IRSA Inversiones y Representaciones Sociedad Anónima (IRS)

IRS Intrinsic Value

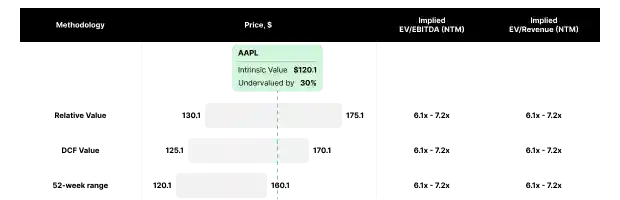

Intrinsic Value of IRS Overview

IRS Historical Intrinsic Value

IRS Valuation Metrics

IRS DCF Model

IRS DCF Value

IRS Earnings Power Value and Enterprise Value

IRS Reverse DCF

Competing with IRS Intrinsic Value

Intrinsic Valuation Tools

FAQ

What is the DCF value of IRSA Inversiones y Representaciones Sociedad Anónima (IRS)?

As of today, DCF Value of IRSA Inversiones y Representaciones Sociedad Anónima is $0.0, which is undervalued by N/A, compared to the current market share price of $14.5

How was the DCF Value calculated?

Step 1: Calculating Intrinsic Enterprise Value DCF Value was calculated by estimating IRSA Inversiones y Representaciones Sociedad Anónima future free cash flow and then discounting it, using a chosen discount rate to determine Intrinsic Enterprise Value of $0.0B Step 2: Balance Sheet Adjustments Intrinsic Equity Value is calculated by subtracting Balance Sheet items (Cash & Equivalents, Short-term investments and Total Debt) from previously calculated Intrinsic Enterprise Value. This Intrinsic Equity Value is then divided by the total number of outstanding shares of 0 to determine DCF Value of $0.0

What is the Relative value of IRSA Inversiones y Representaciones Sociedad Anónima (IRS)?

As of today, Relative Value of IRSA Inversiones y Representaciones Sociedad Anónima is N/A, which is undervalued by N/A, compared to the current market share price of $14.5

How was the Relative Value calculated?

Relative Value was calculated by applying various valuation multiples (EV/Revenue, EV/EBITDA, P/E etc.) to IRSA Inversiones y Representaciones Sociedad Anónima financials to determine Relative Value of $0.0

What is IRSA Inversiones y Representaciones Sociedad Anónima (IRS) discount rate?

IRSA Inversiones y Representaciones Sociedad Anónima current Cost of Equity is 26.9%, while its WACC stands at 20.5%. Cost of Equity is used to value equity, while discounting free cash flow to equity holders (such as Net Income or Free Cash Flow to Equity). Weighted Average Cost of Capital (WACC) is used to value the entire firm, while discounting cash flows available to both debt and equity holders (NOPAT or Free Cash Flow to the Firm)

How is Cost of Equity for IRSA Inversiones y Representaciones Sociedad Anónima (IRS) calculated?

The Cost of Equity represents the return a company must offer investors to compensate for the risk of investing in its stock. It's calculated using the Capital Asset Pricing Model (CAPM), which combines the risk-free rate, the stock's beta, and the equity risk premium (ERP). This model considers the inherent risk of investing in the stock compared to a risk-free investment and the market's overall risk. Cost of Equity = Risk-Free Rate + Beta x Effective Risk Premium (ERP) 26.9% = 4.5% + 1.1 x 4.6%

How is WACC for IRSA Inversiones y Representaciones Sociedad Anónima (IRS) calculated?

WACC, or Weighted Average Cost of Capital, is a calculation that reflects the average rate of return a company is expected to pay its security holders to finance its assets. It is a critical measure in financial analysis for valuing a company's entire operations. The WACC formula combines the costs of equity and debt, weighted by their respective proportions in the company's capital structure. WACC = Cost of Equity x Equity Weight in Total Capital + Cost of Debt x (1 - Effective Tax Rate) Debt Weight in Total Capital 20.5% = 26.9% x 25.6% + 2.8% x (1 - 33.7%) x 74.4%