NEW

Stock Screener with Intrinsic Value

On Holding AG (ONON)

Last Price$58.5(2.3%)

Market Cap$19.8B

ONON Rating

Crunching data... Almost there!

ONON Intrinsic Value

ONON Share Price History

1W (1.8%)

1M 3.4%

6M 57.1%

YTD 118.7%

1Y 115.4%

3Y 117.1%

5Y 67.2%

10Y 67.2%

ONON Stock Metrics

Key stats

Income statement

Balance sheet

Cash Flow Statement

Valuation

Ratios

Per share

Per employee

Dividends & Yields

Crunching data... Almost there!

ONON Stock Financials

ONON Income Statement Metrics

Crunching data... Almost there!

ONON Cash Flow Statement Metrics

Crunching data... Almost there!

ONON Income Statement Overview

Crunching data... Almost there!

ONON Balance Sheet Overview

Crunching data... Almost there!

ONON Stock Ratios

Crunching data... Almost there!

ONON Earnings Surprises

Crunching data... Almost there!

ONON Dividends

ONON Dividend Yield

Crunching data... Almost there!

ONON Dividend Per Share

Crunching data... Almost there!

Competing with ONON

Overview

Ratings

Valuation

Growth

Profitability

Health

Capital allocation

Momentum

Earnings

Dividends

Crunching data... Almost there!

FAQ

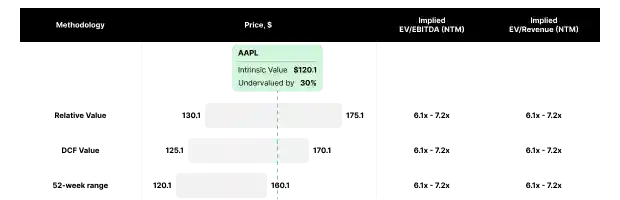

What is On Holding AG (ONON) stock rating?

As of today, On Holding AG has a stock rating of N/A (out of 10), which is considered Great.

is On Holding AG (ONON) a good stock to buy?

As of today, On Holding AG has a Great stock rating, which is N/A undervalued. According to Value Sense backtesting, stocks with similar profile tend to outperform the market by 12.8%.