Magnificent 7 stocks

Discover the Magnificent 7 stocks—market leaders with stellar performance. Learn what they are and track their latest metrics.

The "Magnificent 7" stocks represent the most influential companies in today's market, offering exceptional growth potential and innovation leadership. This elite group, known for its market dominance and adaptability, consists of high-performance stocks that are reshaping entire industries and driving market trends.

Overview

Ratings

Intrinsic Value

Valuation

Growth

Profitability

Health

Capital allocation

Momentum

Earnings

Dividends

Company name | Market Cap | Quality rating | Intrinsic value | 1Y Return | Revenue | Free Cash Flow | Revenue growth | FCF margin | Gross margin | ROIC | Total Debt to Equity |

$3,646.5B | 7.4 | $76.4 67.9% overvalued | 36.4% | $395.8B | $101.2B | 2.6% | 25.6% | 46.5% | 270.8% | 3.0% | |

$2,933.9B | 7.0 | $438.3 12.8% undervalued | (5.8%) | $261.8B | $70.0B | 15.0% | 26.7% | 69.4% | 27.5% | 20.6% | |

$2,913.7B | 8.3 | $56.7 50.2% overvalued | 33.7% | $130.5B | $60.9B | 114.2% | 46.6% | 75.0% | 191.2% | 12.6% | |

$2,203.0B | 7.1 | $118.7 42.1% overvalued | 15.5% | $638.0B | $32.9B | 11.0% | 5.2% | 48.2% | 18.6% | 47.4% | |

$2,079.9B | 7.9 | $163.9 2.8% overvalued | 26.1% | $349.8B | $72.8B | 13.8% | 20.8% | 58.3% | 36.4% | 6.9% | |

$1,693.1B | 8.4 | $443.9 32.2% overvalued | 31.8% | $164.5B | $54.1B | 21.9% | 32.9% | 81.7% | 38.1% | 26.9% | |

$968.7B | 6.3 | $20.0 93.0% overvalued | 51.3% | $97.7B | $3,648.0M | 0.9% | 3.7% | 17.9% | 9.5% | 11.1% |

The Magnificent 7 stocks today include tech giants Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL), Amazon (AMZN), NVIDIA (NVDA), Meta Platforms (META), and Tesla (TSLA). These Mag 7 stocks collectively represent a significant portion of the S&P 500's market capitalization and influence market movements through their Magnificent 7 stocks price performance.

Improve returns with AI recommendations

Keep track of upcoming earnings reports from top companies

CSCO

Last Price

63.48

(1.0%)Market Cap

$256.2B

6

total score

21.8%

undervalued

ABT

Last Price

140.22

1.6%Market Cap

$242.4B

7

total score

24.5%

undervalued

MRK

Last Price

93.15

1.0%Market Cap

$234.1B

7

total score

25.7%

undervalued

AMGN

Last Price

310.78

0.9%Market Cap

$167.9B

6

total score

48.7%

undervalued

AMD

Last Price

98.23

(1.6%)Market Cap

$164.7B

7

total score

32.8%

undervalued

LMT

Last Price

451.94

0.3%Market Cap

$106.7B

5

total score

48.9%

undervalued

Explore more stock ideas

Low P/E stocks

Explore the best low P/E stocks to buy in 2025, featuring top companies trading at low P/E ratios.

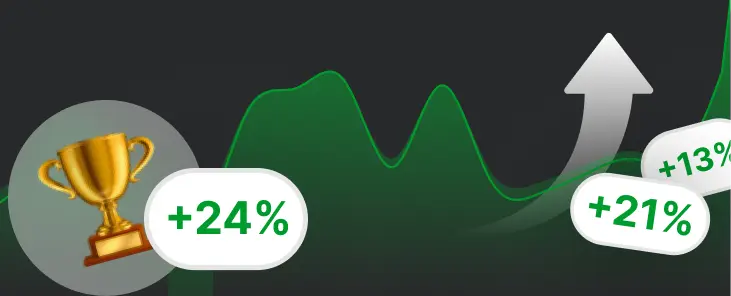

3M Return 7.5%

S&P Outperformance -5.5%

Next 3M Predicted Return 10.2%

Top Weekly Performers

Explore the top weekly stock winners for 9 Mar 2025, outperforming the market and delivering gains.

52 week low stocks

Stay informed on the latest stocks trading at 52-week lows, highlighting those facing downward pressure in the market.

3M Return -12.3%

S&P Outperformance -25.3%

Next 3M Predicted Return 5.1%