Loved by

investors

worldwide

investors

worldwide

10K+

Investors

use our platform

#1

Top value investing hub

with all necessary tools

1K+

Experienced investors

in our community

4.9

Average rating across

all rating platforms

Best stock ideas on the market right now

Undervalued dividend stocks, low P/E, high ROIC, and more

Undervalued stocks right now

Discover the top 20 best undervalued stocks to buy for Mar 2025, listed on the Nasdaq or NYSE.

3M Return 32.1%

S&P Outperformance 19.1%

Next 3M Predicted Return 20.3%

Low P/E stocks

Explore the best low P/E stocks to buy in 2025, featuring top companies trading at low P/E ratios.

3M Return 7.5%

S&P Outperformance 5.5%

Next 3M Predicted Return 10.2%

Undervalued dividend stocks

Discover the top 20 best undervalued high-yield dividend stock that offers both growth potential and attractive dividend returns for Mar 2025.

3M Return 28.4%

S&P Outperformance 15.4%

Next 3M Predicted Return 16.9%

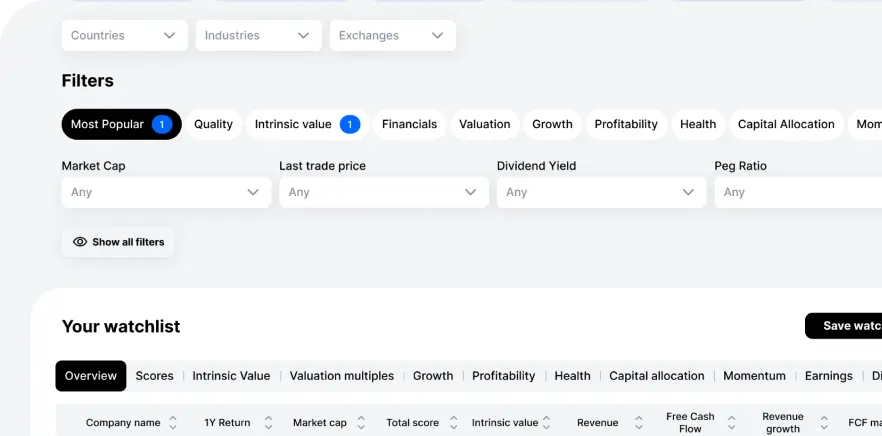

Stock Screener

Find your perfect stocks and keep an eye on them

Value Sense Essentials

Compounding Quality

Heavy Moat

Low P/E High ROIC

More

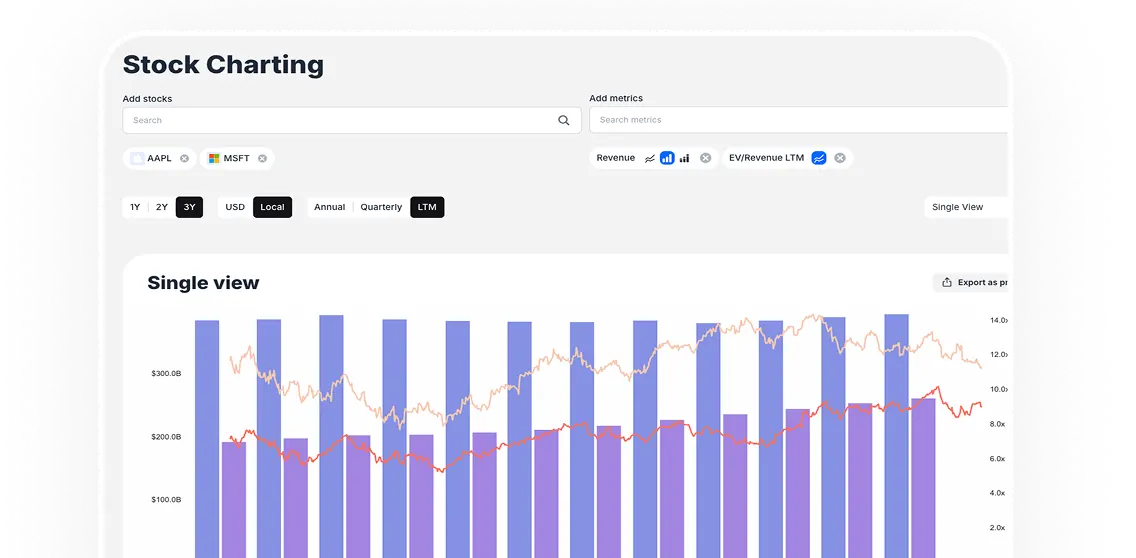

Stock charting

Free charing tool for professional financial data visualization.

Combine data

Build multiple charts

Explore stock charting

Intrinsic Value calculators

Undervalued stocks right now

Discover Hidden Gems in the Market

Overview

Ratings

Intrinsic Value

Valuation

Growth

Profitability

Health

Capital allocation

Momentum

Earnings

Dividends

Company name | Market Cap | Quality rating | Intrinsic value | 1Y Return | Revenue | Free Cash Flow | Revenue growth | FCF margin | Gross margin | ROIC | Total Debt to Equity |

$2,909.0B | 7.0 | $431.5 10.3% undervalued | (8.2%) | $261.8B | $70.0B | 15.0% | 26.7% | 69.4% | 27.5% | 20.6% | |

$916.5B | 8.4 | $332.6 88.2% undervalued | 27.7% | NT$2,894.3B | NT$894.9B | 33.9% | 30.9% | 56.1% | 29.1% | 22.8% | |

$479.1B | 6.0 | $641.9 24.2% undervalued | 6.8% | $396.6B | $20.7B | 7.9% | 5.2% | 21.6% | 17.9% | 75.0% | |

$438.2B | 6.5 | $182.5 19.9% undervalued | 19.3% | $55.8B | $5,812.0M | 6.2% | 10.4% | 69.8% | 15.5% | 557.8% | |

$393.8B | 6.0 | $196.9 20.3% undervalued | 8.4% | $88.8B | $18.1B | 4.3% | 20.3% | 69.1% | 15.7% | 51.2% | |

$370.7B | 6.0 | $301.2 43.4% undervalued | 22.6% | $56.3B | $17.8B | 3.7% | 31.7% | 73.6% | 8.3% | 1,996.0% | |

$317.5B | 6.3 | $277.1 1.7% undervalued | 41.2% | €34.2B | €4,423.0M | 9.5% | 12.9% | 73.0% | 9.0% | 23.3% |

Explore stock ideas

Low P/E stocks

Explore the best low P/E stocks to buy in 2024, featuring top companies trading at low P/E ratios.

Companies with low debt

Discover top companies with low debt to equity ratios, highlighting those with strong financial stability and reduced bankruptcy risk.

High ROIC stocks

Discover high ROIC stocks in 2024 that generate returns on invested capital, driving sustainable growth and profitability. 50 stocks

Today's Market Movers

Top gainers

| Company name | Last price | Intrinsic value |

$0.2 37.8% | $1.1 417.9% undervalued | |

$11.1 31.9% | $15.9 43.7% undervalued | |

$58.6 30.3% | $0.6 99.0% overvalued | |

$14.3 23.6% | $14.6 2.0% undervalued | |

$8.3 19.2% | $7.2 13.5% overvalued | |

$4.9 13.7% | $0.1 97.2% overvalued | |

$21.2 12.9% | $29.4 38.4% undervalued | |

$283.3 11.7% | $86.2 69.6% overvalued | |

$5.3 11.7% | $2.4 53.8% overvalued | |

$2.5 11.5% | $5.2 103.8% undervalued |

Top loosers

| Company name | Last price | Intrinsic value |

$0.7 29.0% | $0.7 8.8% undervalued | |

$5.8 17.8% | $7.2 23.6% undervalued | |

$1.1 14.0% | $1.0 10.9% overvalued | |

$12.4 13.6% | $9.9 19.8% overvalued | |

$285.5 12.6% | $293.6 2.8% undervalued | |

$10.1 10.9% | $15.3 52.3% undervalued | |

$3.2 10.8% | $1.0 67.1% overvalued | |

$3.8 10.6% | $3.3 14.0% overvalued | |

$40.0 10.6% | $1.6 96.0% overvalued | |

$4.0 10.3% | $19.2 378.1% undervalued |

Value Sense blog

More insights & guides

Crunching data... Almost there!

Market summary

Get a comprehensive overview of today’s market performance & major shifts

Crunching data... Almost there!

Earnings calendar

Check out the most interesting companies expected to release earning reports

Clear all filters

24 - 28 March

mon

24

KBH

EPAC

LUNR

tue

25

MKC

GME

CNM

PHI

PRGS

WOR

ATAT

wed

26

CTAS

PAYX

DLTR

CHWY

RUM

RH

ALVO

FUL

CNXC

VRNT

MLKN

SCS

thu

27

SNX

WBA

MSM

BRZE

CNTA

AGX

MNPR

fri

28

SBS